In this section, Prof. Gensler offers an overview of the role of artificial intelligence in the finance sector.

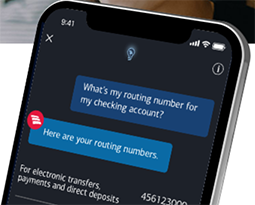

Natural language processing has allowed the development of digital assistants that simplify online banking. (Photo © Bank of America. All rights reserved. This content is excluded from our Creative Commons license. For more information, see https://ocw.mit.edu/help/faq-fair-use.)

The greatest changes of the early 2020s are about artificial intelligence, and more specifically two forms of artificial intelligence. One is machine learning. “Machine learning” is a fancy term for new methods of data analysis. We can analyze data somewhat like the way our brain works, using neural networks to extract correlations from data where we couldn't find them with earlier forms of math like linear algebra. The second form of artificial intelligence that's dramatically changing finance is natural language processing—technologies that translate human language to computer language. We may not love them, but robo-advisory platforms using natural language processing can deliver finance far more broadly to far more people. For instance, Bank of America has its natural language processing assistant, called Erica. Millions of their customers are now using Erica to do modest transactions such as moving bank balances around.

What will the next technologies be, and how can we think of an entrepreneurial strategy to use those technologies to provide services?

— Prof. Gary Gensler

So artificial intelligence is dramatically shifting finance, both through the ability to extract patterns where we didn't see patterns before and through natural language processing. Using those technologies, startup companies have been able to chip away at incumbents and offer new services. In the classroom I try to think about this with students and ask, after machine learning and natural language processing, what will the next technologies be, and how can we think of an entrepreneurial strategy to use those technologies to provide services?